Like many traders, I read Market Wizards as a kid. If you don’t know it, it’s a collection of interviews with the most legendary traders of the 1980s.

Back when I first read it, I really had no idea what the hell I was doing. I read it, thought I got it and moved on.

But I didn’t get it.

The reason was simple. I didn’t have the life experience and wisdom to understand it. That would take many, many more years.

A few months ago I picked up my old, dog eared and highlighted copy and started thumbing through it. I expected to snag a few quotes and move on but pretty soon I found myself hooked, reading it cover to cover all over again.

Two things struck me immediately.

- First, I’d highlighted all the wrong things.

- Second, I saw instantly how much these men were alike.

No matter where they came from or how they got started, they all remembered one devastating loss early in their career. They all started with little to no idea what they were doing. All of them transcended false beliefs and developed an amazing ability to adapt and change their minds in a flash.

Their styles, politics and temperament all varied widely but the rest of their lives followed a remarkably similar path.

That’s when I realized I was seeing something bigger, a meta-pattern, a pattern of patterns.

Call it the journey of the great trader.

So what is that path and how can you follow it?

Let’s take a close look.

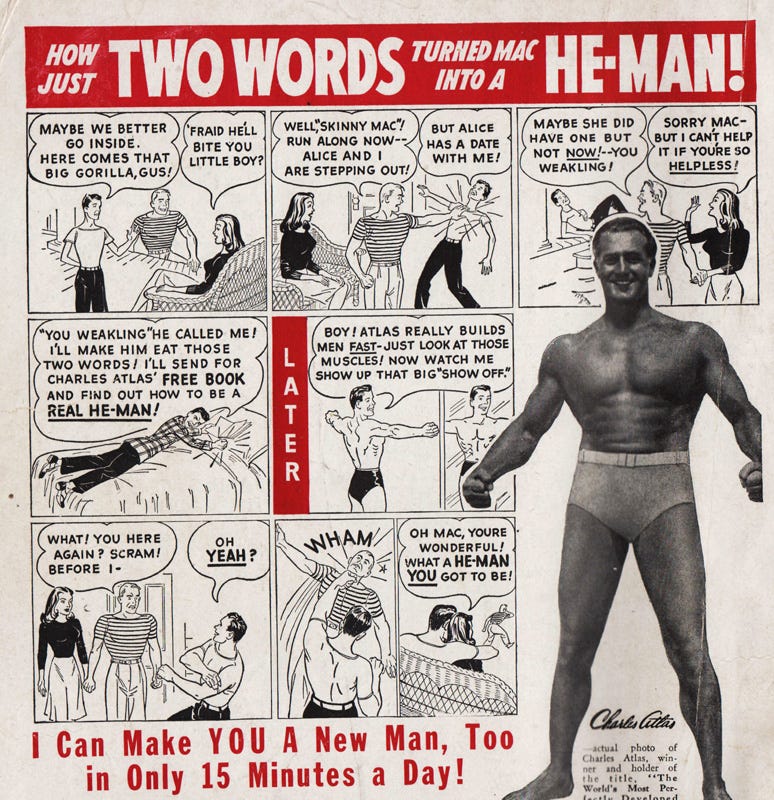

Number One: Start Out Clueless

No matter how good anyone gets at something they always start out clueless. Maybe trading is some innate gift but that doesn’t matter at all at first. Everyone starts at step one.

Nobody starts off a superstar.

This Wizards excerpt from Michael Marcus is typical of most traders.

“Q: Did you know anything at all about what you were doing? Had you read anything about commodities or trading?

A: No, nothing.

Q: Did you even know the contract sizes?

A: No, we didn’t.

Q: Did you know how much it was costing you per tick?

A: Yes.

Q: Apparently, that was about the only thing you knew.

A: Right. Our next trade, in wheat, didn’t work either. After that, we went back to corn and that trade worked out better; it took us three days to lose our money. We were measuring success by the number of days it took us to lose.”

You see the same story again and again. Somebody hears about how they can get rich quick in the market. Their friend tells them or they read a story about some king of Wall Street or the newly crowned crypto rich and they leap in hoping to make a quick buck, their eyes filled with stars.

Even if they do have some idea about the basic rules, like setting good stops and choosing a position size that won’t wipe them out they almost always ignore it.

Paul Tudor Jones, a super aggressive, hard charging trader, tells the tale of a horrible early trade where he made a spur of the moment “macho man” cotton buy leaving him seriously vulnerable. Immediately the other pit traders knew his mistake and he did too. The big whale of the cotton market started dumping on him almost instantly, driving the price down hard and locking him in.

He learned the hard way “Never play macho man with the market” as he wiped out 70% of his equity in a single trade.

Every single person thinks they’re smarter than the market. Even if they read the time honored rules of the best of the best they’re thinking “those don’t apply to me, I’m different.”

And that takes us to step two.

Number Two: Make the Same Mistakes as Everyone Else

Think you’re immune to making the same mistakes everyone else does?

You’re not. But don’t worry, you’re in good company.

Nobody is immune.

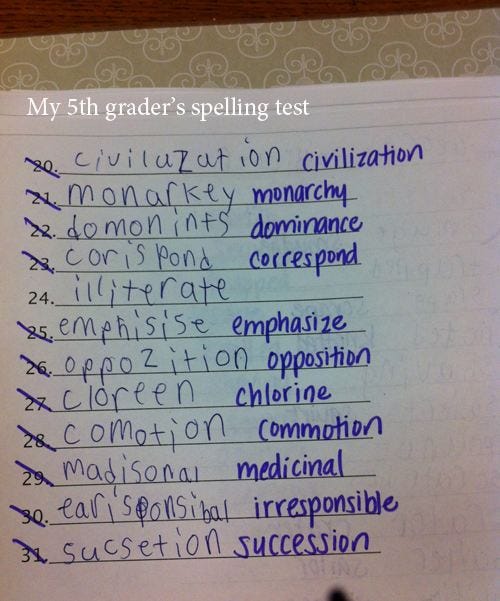

Inevitably new traders don’t understand why the rules are there to protect them even if they know the rules. Maybe after their clueless stage they read a few books or listen to some smart sounding traders on Twitter or take a course.

The problem is they don’t really understand what they’re reading and hearing. They can’t process it yet because they don’t have the experience to see the wisdom in it, even if they understand it partially at the intellectual level. Knowledge can’t be passed on passively. It has to be earned through personal experience.

And when you don’t understand the rules, what happens?

You screw up.

And what are some of those rules?

1) Don’t overtrade.

2) Keep your position sizes small.

3) Set stop losses.

4) Don’t make snap decisions.

5) Don’t get too high or too low emotionally.

Those are just a few of the essential pearls of wisdom that every trader eventually figures out.

Eventually.

The hard way.

In the beginning everyone just glosses over them.

Legendary currency trader Bruce Kovner tells a classic story about snap decisions. Kovner made his original money hedging spreads on contracts. He’d be long one contract and short another to reduce the risk but as soybeans rocketed to new highs in the 1970’s his broker got caught up in the euphoria and called him wild with greed:

“Soybeans are going to the moon…You are a fool to stay short the November contracts. Let me lift your November shorts for you, and when the market goes limit-up for the next few days, you will make more money.”

He agreed. Limit-up is a circuit breaker on the markets. If they went too high or too low the contracts locked and nobody could trade them. You were stuck. Limit-up meant you were making the absolute most money possible. Limit-down? You were losing the most money possible and even worse you were stuck and you couldn’t sell out.

Kovner perfectly describes the crazy euphoria every early market apprentice feels:

“It was a moment of insanity. Fifteen minutes later, my broker calls me back, and he sounds frantic.

‘I don’t know how to tell you this, but the market is limit-down! I don’t know if I can get you out.’ I went into shock. I yelled at him to get me out.”

By sheer luck he managed to get out when the markets ticked up past limit-down for a few minutes but not before eating a massive loss.

Afterwards, Kovner talks about the sickness every trader feels when they make a horrific trade and the market eats them alive.

“I was up about $45,000. By the end of the day, I had $22,000 in my account.”

And that brings us to our very next step on the journey of trader enlightenment.

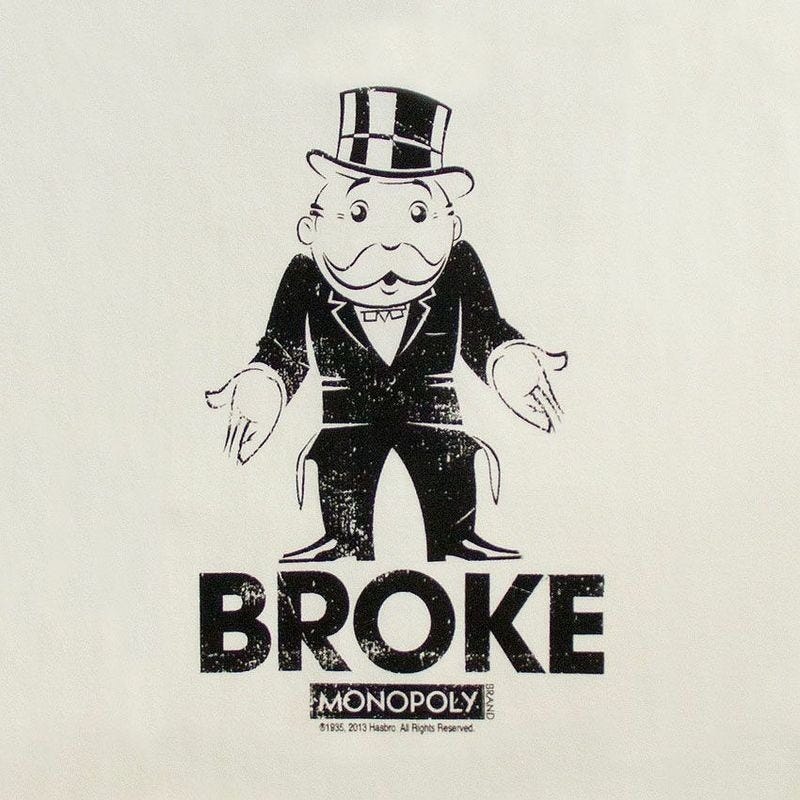

Number Three: Take a Big Loss

Every single trader will eventually experience a catastrophic, heart breaking loss. Many of the best traders went completely belly up, more than once. The original great speculator, Jesse Livermore, lost multiple fortunes.

Kovner tells us the gut wrenching sickness of losing big money in the market.

“I went into emotional shock. I could not believe how stupid I had been — how badly I had failed to understand the market, in spite of having studied the markets for years. I was sick to my stomach, and I didn’t eat for days. I thought that I had blown my career as a trader.”

Michael Marcus tells a similar story of a disastrous sugar trade.

“Q: How much did you lose on the trade by the time you liquidated?

A: I lost my own $30,000, plus $12,000 of the $20,000 my mother had lent me. That was my lesson in betting my whole wad.”

Every trader has a story like that to tell. For me it was NEO. I got in late in the bull run and bet big. I just knew it was going to the moon and a few days later I was riding high and I nearly doubled my money.

And then the empire struck back.

China started threatening the big exchanges. It seemed every single weekend there was a brand new story attacking crypto, a big banker saying it was worthless or insane, China cracking down, or another country looking to ban trading.

It didn’t take long for the markets to panic.

And there was no worse coin to hold at the time than a Chinese coin. That’s exactly what NEO was, red Chinese through and through.

I watched my wins vaporize over the course of two days and I just froze. I panicked. I liked the coin and the project, I thought it would turn around so I just hung on as it went down and down and down.

In the end I lost 68% of what I put in.

I was sick to death. I couldn’t sleep or eat for days. Working out didn’t help. Getting a massage didn’t help. Alcohol didn’t help. Whacking it didn’t help. Nothing helped.

Only one thing could fix it. The next step.

Step Four: Reflect and Come Back Stronger

Once you finally experience that soul crushing loss it’s not long after that you realize it was the absolute best experience of your trading life.

If you’re smart and you’re focused you start looking at everything you did wrong. You go over it with a fine tooth comb. You question all your beliefs and ideas. No longer are you willing to just take things at face value. You want to know what works and what doesn’t and so you finally get serious.

Paul Tudor Jones remembers reflecting on his mega-loss and getting so depressed he wanted to quit. But then it hit him:

“It was at that point that I said, ‘Mr. Stupid, why risk everything on one trade? Why not make your life the pursuit of happiness rather than pain?’

That was when I first decided I had to learn discipline and money management. It was a cathartic experience for me, in the sense that I went to the edge, questioned my very ability as a trader, and decided that I was not going to quit. I was determined to come back and fight.”

Real loss equals real wisdom.

Without that loss none of the lessons make any sense to you whatsoever. You’ll think you’re different and that the rules don’t apply to you.

But they do. They apply to everyone. No exceptions.

Step Five: Learn the Age Old Lessons the Hard Way

What is it about the human mind that makes us learn all our lessons the hard way? We read the great wisdom of the ages and promptly ignore it.

Maybe that’s just the meaning of life? We all have to go through the same struggles and make our own mistakes and live the great story again and again.

After my big NEO loss I reflected on everything I’d done wrong and it hit me like a diamond bullet between the eyes. I realized I didn’t know how to make decisions when I was under fire. I just froze like a deer in headlights. I knew the market had turned and that NEO was going down and I should get out but I couldn’t pull the trigger.

Internally, I just couldn’t accept the loss. I was in denial. I was a good trader and careful or at least I thought I was but now I was faced with a new reality.

I wasn’t as good as I thought I was. And I couldn’t accept the reality in front of me. I couldn’t put it behind me and move on.

I should have sold that NEO shit stack long before it cost me a big chunk of change. Instead I road that loser all the way into Hell instead of cutting my losses.

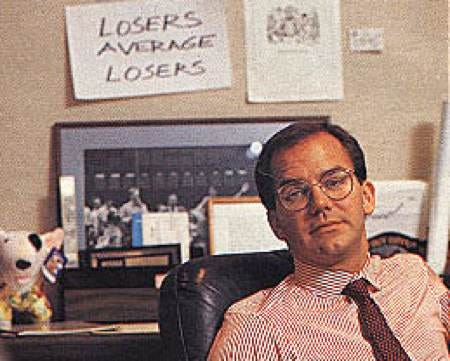

As Tudor Jones says “losers average losers.”

People love to hang onto losers. They love the pain. Oh they won’t admit it but they do. Pain is drama. And people love drama.

Either that or they imagine the market merely lost its mind for a minute. The project is a good project. Things will turn around.

Except more often then not they don’t turn around or they turn around too late and because you held so long you can’t make up that loss.

And it doesn’t matter if gold is good or a company is good or a project is good. Sometimes that doesn’t mean a damn thing to the market and it just tanks. Saddling up that bomb and cowboy riding it to the bottom is always a disaster.

NEO taught me the most important lesson of all.

More importantly I now understood the lesson:

“Cut your losses, let your winners run.”

Step Six: Money Management

The ancient wisdom really boils down to two words: Money management.

Cutting losses is one of those key principals that everyone has to learn. It’s not enough to simply trade the market, you have to know you’re going to get things wrong a lot of the time. And that means you have to protect your money at all costs.

That’s just basic probability.

Paul Tudor Jones says “I am always thinking about losing money as opposed to making money…I have a mental stop. If it hits that number, I am out no matter what.”

Money management comes down to a few critical principals:

1) Keep your position sizes small to minimize risk

2) Ruthlessly cut your losses.

3) Always use stops.

4) Don’t use too much leverage

5) When you start losing, start trading smaller.

6) When you go on a bad streak, get out of everything and take a break.

7) If you get in a bad trade, get out immediately because you can always get back in later.

All of these principals work in tandem to protect your money.

I learned this the hard way yet again just the other day, when I went a little too heavy on a leveraged position after a strong winning streak.

The mistake was easy to see in retrospect.

What blinded me at first was that I’d gotten masterful at setting my stops. One of my tricks is to set a limit stop price far above or below the trigger so it always gets filled. I’d never had a stop not fill and I’d never gotten liquidated. I don’t get liquidated because I use just enough leverage to make a difference but not enough that the market would only have to move a few percentage points to kill me off.

I put in my trade, set my stop and went to bed.

When I woke up in the morning and checked in I saw I was down 29%. My stop never triggered. I wasn’t liquidated because I hadn’t over-leveraged but it didn’t matter.

I was sick to my stomach.

So what did I do?

Number two, ruthlessly cut loses.

After a few minutes of feeling sorry for myself and thinking I should hold on because maybe it would come back I shut that stupid voice up and sold. I cut that loss immediately. I took it and moved on.

That’s when I understood once more that all the principals work together in concert.

If the position size had been smaller the overall loss would have been smaller. But because I hadn’t used too much leverage I hadn’t gotten liquidated so I was still very much protected.

Low leverage, small positions and stops all work as one. Sometimes one of these risk management tools fail you and the others kick in to help. It’s like the seat belt and the airbag.

Sometimes the seat belt isn’t enough but the airbag is there to save you.

Step Seven: Stop Following Others

It may seem strange to say that I don’t follow other traders or the news but I don’t follow any of them anymore. I may occasionally glance at a chart of a trader who I really respect and see if it matches with my sense of the market but it’s incredibly rare. I might also check in with a trader who I know well and who’s had success over the long run.

And then I just do what I want anyway.

In the end you have to follow your own light.

You have to get so good that you trust your own analysis above all else. When you make a mistake you need to know you’re strong enough to figure out what it was and fix it the next time.

If you’re meant to be a good trader you will be. It’s as simple as that.

Ed Seykota is one of the best traders profiled in Wizards. He says is best:

“It is a happy circumstance that when nature gives us true burning desires, she also gives us the means to satisfy them.”

If you have that burning desire to trade and to win, you’ll find a way and you won’t need to follow anyone else once you get your feet wet.

I have my school of traders but my main lesson to them is simple. Learn from me and then move on. Become your own master. Don’t sit at the feet of gurus your whole life.

As for the news? Nothing but poison. Turn it off as fast as you can.

I highly, highly recommend every single human being take a news fast for a month. Disable anything related to news on your phone feed. Unfollow everyone on Facebook. Don’t read the Twitter stream. Get a site blocker for when you’re working and use it frequently.

I guarantee you, you will not miss out on anything. If something really, really big happens you’ll hear about it because people will talk about it. If it’s not big enough to be on everyone’s lips it’s not worth hearing about.

Here’s another thing I guarantee. You will be mentally, emotionally and spiritually healthier by an order of magnitude. Your anxiety will decrease as will your confusion and fear.

You’ll probably end up extending the news fast indefinitely. I know I did.

I could care less about Google News or which coin some random person on the Internet thinks is going to the moon tomorrow based on astrology and hope. Probably the last time I followed news was during the China crisis. And if I had to do it all over again, I wouldn’t read a word of it this time. I do occasionally read one magazine that I like with strong, consistent journalism but even that is less and less frequent, maybe once a month or every few months and mostly because there is one story I want to read in depth.

When you give up on the news you’ll be in fine company.

Ed Seykota said “eventually I became more confident of trading with the trend and more able to ignore the news. I became more comfortable with the approach.”

I have not met a single good trader who is a news junky even though the average trader is a hopeless news junky. They want a reason for the market to go up or down. They can’t face that it’s random chaos and the push/pull of a billion emotional monsters.

So writers come up with a good reason for why the market made a move. Interest rates changed. A trade war looms. A big soybean shortage struck. Some of these are probably factors but it’s really impossible to use that news in any effective way 99% of the time. The other 1% of the time it is but so what? Is it really worth watching 99% white noise to get that?

Even worse, news is about conflict and tragedy. It’s about pain and suffering. It’s about extraordinary events.

But the more you watch it the more you think those extraordinary events are normal events.

Plagues happen every day. People get shot up around the corner every few seconds. A baby is butchered every ten minutes in your town.

If you’re born in an insane asylum and everyone is screaming all the time you think it’s normal.

It ain’t normal.

You’re hearing about statistical outliers and it does nothing but warp and derange your mind.

The news is poison.

Bite your arm, suck that venom and spit it out for good.

Step Eight: Develop Your Own Style

If you make it this far, you’ve come to the final step on the journey of trading mastery.

What’s that?

Develop your own system.

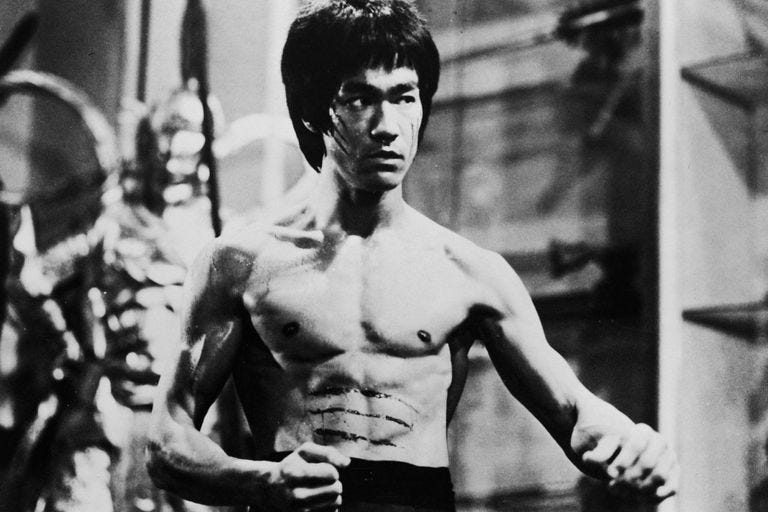

I used to study Kung Fu. I noticed that most people were obsessed with lineage. Who was the great master that taught their great master in an unbroken line over five hundred years? Did the system change? Was it passed down perfectly and directly?

I soon realized this kind of thinking was total madness. Of course the system changed. Each master learned new lessons through his own life experience and added that to the system. It he didn’t, he was no master. In fact, he probably sucked horribly if he just photocopied what his teacher taught him and passed it down to you.

And I also found myself thinking about the first person in that line of legendary martial artists. If you go back far enough, eventually you get to someone who started the system. That brings up one inevitable question:

Who taught them?

The answer is obvious.

Nobody.

They taught themselves.

And that is what the absolute best of the best do in all fields. They don’t follow. They create.

The old Kung Fu masters didn’t just learn from someone else and regurgitate it. They took what they learned and modified and improved it. They studied nature and themselves. They watched the movement of snakes and birds and they tried to tease out the secrets of those animal powers. They wanted to move as fast as a snake and strike like a tiger. They had everything they needed by observing the world around them.

You must become the master. When you get there you’ll find there’s nobody handing out a belt. You’ll be the final judge in your journey.

And that means eventually you’ll need to develop a trading style that perfectly fits your own personality, your own strengths and weaknesses. If you’re just following someone else’s picks blindly you won’t have to strength to stay in a trade when the going gets really rough. That kind of confidence only comes from within.

To do that you’ll have to look deep inside and figure out what you really want from the world.

As Ed Seykota says, “Everyone gets what they want out of the markets.”

Some people like to lose. Some people like to play the Martyr. Some folks like to be popular. Others love to be contrarians and bet against the crowd. Still others like to sound smart at parties. But they don’t like to make money. They might even think it’s dirty or evil and they self sabotage.

Whatever your weakness the market will happily feed it to you. If you love the excitement of winning big and then losing it all and making it back again, you’ll get that too.

Ed went further: “I think that if people look deeply enough into their trading patterns, they find that, on balance, including all their goals, they are really getting what they want, even though they may not understand it or want to admit it.”

But the best traders do want to make money. They have a deep passion for the markets and a burning desire to win. To do it they all come to the same understanding eventually by reflecting deeply and transcending their own human limitations to become the best of the best.

And when they do they’re ready to walk their own path, a lonely path, but a joyous one too:

The path of the master.

They no longer need to read any more books or listen to anyone else or follow anyone else’s star.

They become their own guiding light.

They live and die by their own decisions. When they win they don’t get too high. When they lose they don’t blame anyone but themselves.

And they don’t need any outside validation or praise or judgement.

That’s because after all that time and effort and suffering, they finally knowwhat they’re doing. It’s not arrogance. It’s an internal compass that is unflinchingly accurate, developed only through dedication, perseverance, persistence and passion.

It’s earned over time. A long time. Nothing else can give it to you.

It can’t be bought, bargained for, or cheated. There are no short cuts and there never will be.

And all the praise and validation the legendary trader will ever need will show up in the only place that matters.

Their bank account and crypto wallet.

###########################################

Recent Comments